Managing documents is not at the top of an entrepreneur’s favourite activity list. Maintaining original records has long been a dilemma for companies of any size. In the past, businesses that generated a high number of transactions were inundated with paper in the form of invoices, receipts, reports, correspondence and tax returns. Papers were shuffled from desks, cash registers and retail counters into banks of filing cabinets and eventually into boxes in some sort of storage area. As time passed and the business grew, the problem of document storage and retrieval became more and more acute. Space that should be used to generate income became dead space. Revenues that could be reinvested were used to pay for more and more storage.

Business Records Retention Schedule for Small Business

Topics: document scanning, document imaging, records retention

We are exposed to more types of data in a growing number of formats as information technology continues to advance. Despite this growth, we typically find it both easier and necessary to deal with more mundane forms of information transfer, primarily in the form of paper documents. To expedite the communication between the past and the present, and to bring the sharing of information up to speed, equipping your staff with portable document scanners is key. Below is an outline of some of the features and useful capabilities that you can expect when you choose a portable document scanner.

Topics: paper scanning, Scanners, portable scanner

How to Organize Files in the Office with Document Management Software

Technology has done so much to make it easier to manage and organize your business, but when it comes to files, things can get messy. Employees may save files to the wrong area, make multiple copies, or even delete copies. What you really need is to effectively implement reliable document management software. The key to getting your documentation in order is to find a solution that organizes your files in a manner that is easy to search, check out, store, and maintain configuration control.

Topics: Document Management and ECM

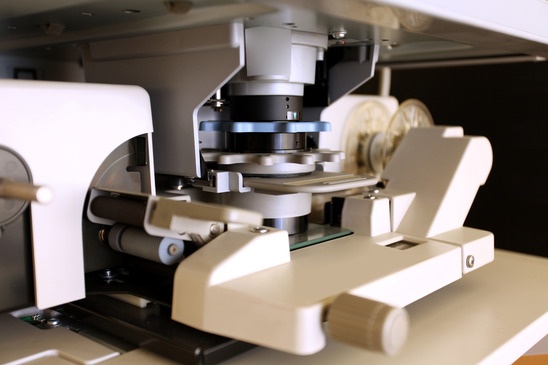

For years, microfiche technology has allowed organizations like yours to easily store its data in high volumes without taking up the same amount of space as a full sheet of paper. That being said, microfiche has been usurped by a more effective technology: the computer. Here are some reasons why you should have your microfiche images professionally converted to digital files.

Topics: microfiche scanner, micrographics, Microfiche Scanners, microfiche

No matter what risks threaten your company's data, total document security is possible. As you know, document security is not something that just happens, so you need to actively take steps to protect your company's information – simply putting everything under lock and key is not enough. That being said, here is what you need to do:

Topics: security, document security

Paperless Office Solutions for Educational Institutions

As a recent real-world experiment conducted by Yale University has proven, an educational institution such as yours can save hundreds of thousands of dollars in expenses each year by simply reducing the amount of paper that it uses. Something that the results of the experiment didn't note is that having less paper to store, organize and retrieve will also allow all of your faculty and staff to operate more efficiently. That being said, you can't simply get rid of your paper, because it plays a critical role in the majority of your institution's routine activities. To make cutting back on paper use a little easier for you, we are going to explore a few paperless office solutions that you can start using right now.

Topics: paperless office, education

Whether it is a tax return, company information, personal data or any other type of document that your company deems important, you need to be able to digitally organize and protect it. To make this happen, you need to have a streamlined system in place that allows you to consistently organize important documents without investing too much time and effort. Here are the three steps that you need to take in order to make this happen:

Topics: digital imaging, digital storage, digital archives

From paper to the cloud, there are many ways to store your organization's data. That being said, the latter option is the best storage option to save you time and money. Here are the benefits you get from cloud storage for business:

Topics: Cloud Computing, cloud storage

Why Choose Cloud Based Document Management Systems?

Once your company has started taking advantage of the benefits of modern technology by converting its paper documents to digital files, you will need a solution to manage it all. There are plenty of document management solutions out there, and the best among them are cloud based. Here is why you should choose cloud based document management systems over the alternative:

Topics: Cloud Computing, cloud vs. on-site, digital storage, document storage, data storage

Long-Term Storage Solutions For Your Important Documents

Much of your organization's data will matter as much in a decade as it does right now. As such, you need to explore long-term storage solutions to preserve it for as long as you possibly can. To assist you in this matter, we are going to explore the pros and cons of some of the most reliable long-term storage solutions available to you.

Topics: digital storage, document storage, data storage