A clearly defined document retention policy (DRP) provides your company with peace of mind ensuring you remain compliant with all industry and government document retention laws. However, to produce your DRP, rules and regulations need to be clarified. This guide provides a condensed overview of Canadian records retention policy best practices. We also provide recommended retention times for common records based on record retention policies in Canada and valuable links to provincial resources.

What length of time is your business required to maintain records?

The entire schedule is too extensive to list. However, you can review the Canadian records retention schedule broken down by industry and document type here. These are the common records retention policies and schedules impacting most industries:

Documents to Keep for 2 Years

When a corporation is dissolved, the original copies of the following documents must be kept for at least two years following the date of dissolution:

- Deeds

- Board of directors meeting minutes

- Share certificates and transfers

- Any other documents that can be used to justify ledger entries

- Personal records from the last updated information

Documents to Keep for 3 Years

These standards focus on employee records, meaning they can differ for each province. However, best practices would recommend the retention of the following records:

- Employee’s name and address

- Employee’s date of birth if the employee is a student and under 18 years of age

- Date of hire

- Hours worked—if the employee is salaried, then the company is only required to keep records of the overtime hours worked (or not at all if overtime provisions do not apply)

- Pay periods

- Gross and net salary or wages paid, including how they were calculated

- Deductions (amount and purpose)

- Vacation pay or paid vacation taken

- Leaves of absence (all documentation and certificates)

- Termination date

- Termination or severance pay

Documents to Keep for 5 Years

These documents relate to Fintrac (Financial Transactions and Reports Analysis Centre of Canada) Reports:

- Suspicious Transaction Reports

- Terrorist Property Reports

- Large Cash Transaction Reports

- Large Virtual Currency Transaction Reports

- Electronic Funds Transfer Reports

Documents to Keep for 6 Years

These documents are required for tax purposes in Canada:

- Daily income statements with invoices and cash register tapes

- Daily expense statements with canceled cheques and expense receipts

- Travel and company vehicle expense records with supporting documents

- Company credit card bills

- Records with the names of employees, their salaries, and salary deductions

- The end of a non-incorporated business or other organization ends

Documents to Keep Forever

The following documents must be retained indefinitely:

- Deeds

- Board of directors meeting minutes

- Share certificates and transfers

- Any other documents that can be used to justify ledger entries

- The records and supporting documents that might influence the sale, liquidation, or wind-up of the business

What determines document retention standards in Canada?

What determines document retention standards and practices in Canada depends on the industry and document type. The general guidelines are based on the risk of harm caused by the destruction or poor management of records. The industry breakdown for each document type can be quite complex.

For example, accountants have a list that includes tax documents with a six-year retention period, while other financial records require retention for two to 10 years. Personal information is far less specific, with the government stating there is no “one size fits all” retention period. Some organizations have a legislative requirement for personal information, while others have no requirements at all. Therefore, it is critical to ensure you understand the regulations that apply to your business to avoid fines.

Best practices to comply with provincial record retention policy

Because there isn’t a single solution for all industries and document types, it is highly recommended that you follow document retention best practices to remain compliant. Here are four of the most valuable practices to adopt in your DRP:

- Research industry standards: When creating a records retention policy, research industry-specific regulations you are legally obligated to follow.

- Promote storage efficiency: Ensure you have a clearly outlined process regarding record keeping and retention schedules. Use an electronic records management solution with robust search functionality to store electronic files such as emails, customer forms, social media posts, electronic submission forms, etc. You can organize documents by type and create retention deadline folders within those categories.

- Include key stakeholders: Ensure your policy is compiled with input from key stakeholders, including HR, customer service, legal, and accounting. These are the departments most likely impacted by retention policies.

- Include document type guidelines: Because different types of documents fall under various retention regulations, ensure you explore all document types you use within your organization to adhere to legal requirements.

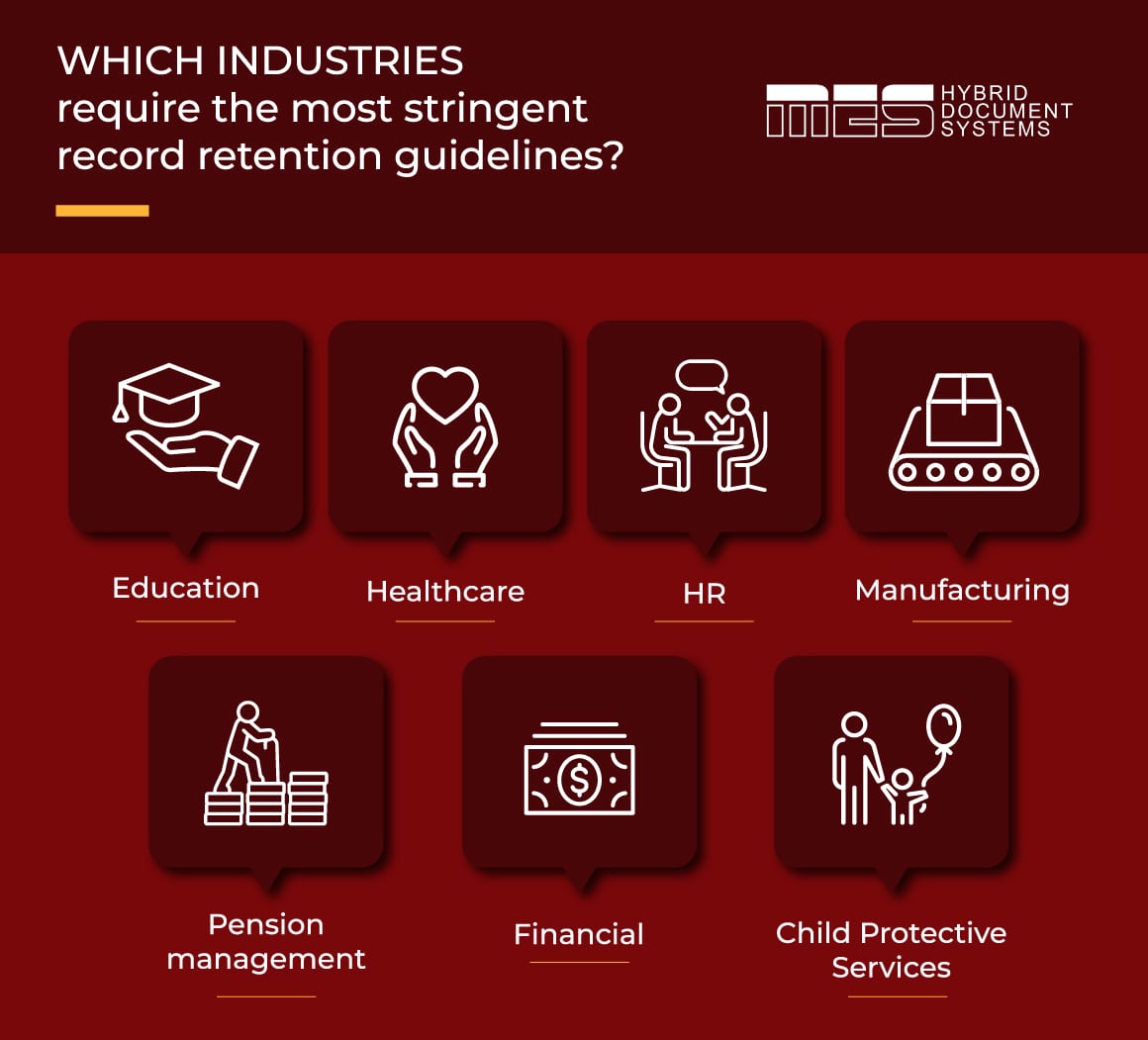

Which industries require the most stringent record retention guidelines?

First and foremost, all organizations must adhere to CRA retention laws retaining all records for six years from the taxation year. Second, all organizations must adhere to their own industry’s personal data laws, with the best rule of thumb to retain personal records two years from the last record update. Now that we’ve clarified guidelines applying to all industries, we can look at the sectors with the strictest guidelines:

- Education: Student records and transcripts are a significant part of school administration, with many records requiring indefinite retention.

- Healthcare: For obvious reasons, healthcare is under strict records-keeping mandates that call for accessible electronic records and backups.

- HR: Both HR companies and HR departments must retain extensive personal records. Also, personnel files are critical to establishing a solid case when faced with challenges regarding labour laws. Documents such as incidence reports in case of termination, proof of hiring a diverse workforce, providing accommodations for differently abled employees, etc., all provide evidence of your compliance.

- Manufacturing: Manufacturing companies face stringent regulations based on procedures, safety, materials, conditions, and more, that demand effective records retention policies to prove compliance.

- Pension management: Pension administration requires historical documentation covering both the collection and allotment of funds.

- Financial: Financial services are mandated by strict Fintrac rules.

- Child Protective Services: Administrators must securely handle historical child welfare files, disposition reports, risk assessments, and safety plans.

Record retention guidelines and laws by province

We’ve compiled a provincial/territorial record retention directory with all available links to record retention laws by province, archive and record retention laws, and employer/payroll regulations. Please contact your province to request their current schedule for unavailable links provided.

Alberta

British Columbia

Manitoba

Newfoundland

New Brunswick

Northwest Territories

Nova Scotia

Nunavut

Ontario

Quebec

Saskatchewan

Yukon Territories

Should I seek professional help?

Yes. Adhering to document storage requirements is always challenging regardless of your industry, business size, or internal retention policies. When you work with a records management service like MES, you can streamline your record retention process, create an easy-to-use archiving system, and sort files based on retention expiries.

To efficiently manage destruction dates, you can simplify the compliance process through a document’s entire lifestyle based on the document type. You can also have a more accessible records system for quick document retrieval, sharing, and improved security. MES has 40 years of experience in compliance, offering customized document management solutions based on industry standards.

We streamline retention processes, manage version, storage, and access control, and improve your overall document management process. Reach out to our team today to learn more about how we can help.